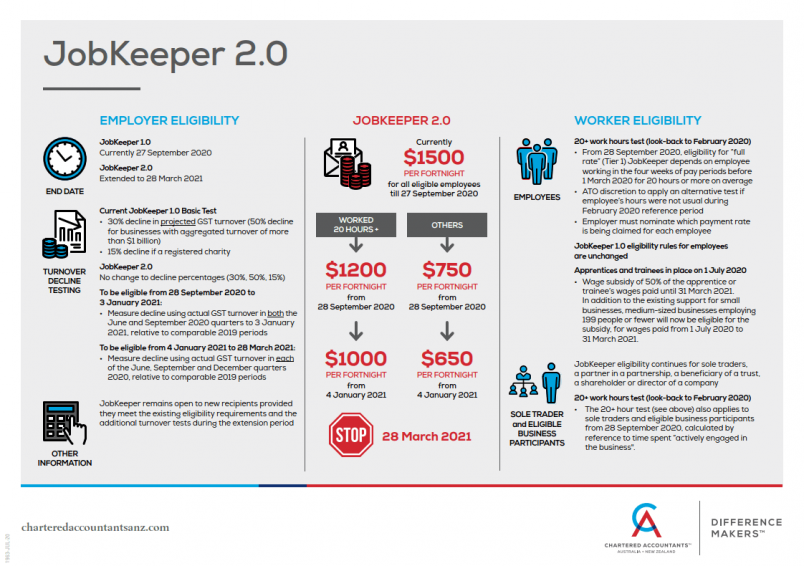

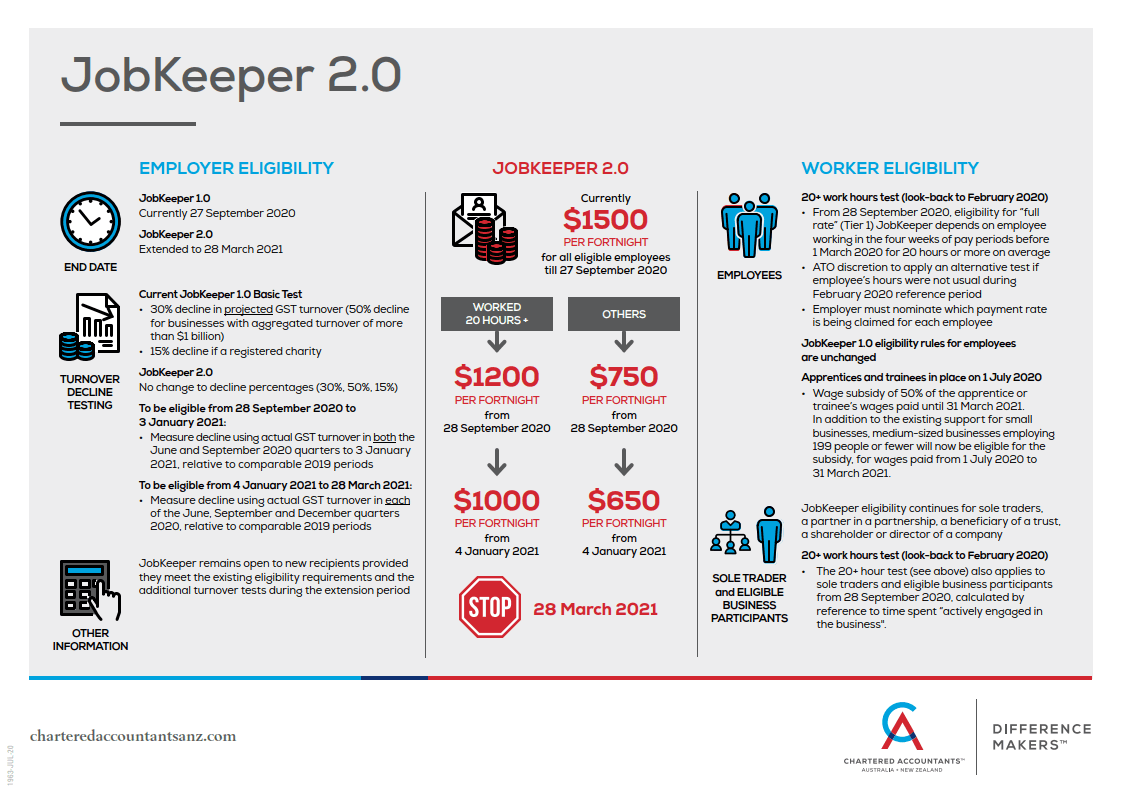

Extension to the JobKeeper Payment

By Charles Talbot

Important changes to the JobKeeper payments from 28 September 2020.

Update: The ATO has updated JobKeeper "2.0". Please see our new blog

post on the topic dated 7 August 2020.

The JobKeeper Payment, which was originally due to run until 27 September 2020, will now continue to be available to eligible businesses

(including the self-employed) and not-for-profits until 28 March 2021.

The First JobKeeper Payment Extension is from 28 September 2020 to 3 January 2021

To be eligible, businesses and not-for-profits will need to demonstrate that they satisfy the actual GST turnover test in the both the June

and September quarter 2020 relative to comparable periods.

Employee eligibility will remain unchanged but the payment rate during this period will be updated to:

-

$1,200 per fortnight (reduced from $1,500) for all eligible employees who, in the four weeks of pay periods before 1 March 2020, were

working in the business or not-for-profit for 20 hours or more a week on average, and for eligible business participants who were actively

engaged in the business for 20 hours or more per week on average in the month of February 2020; and

- $750 per fortnight (reduced from $1,500) for other eligible employees and business participants.

Second Jobkeeper Payment Extension is from 4 January 2021 to 28 March 2021

To be eligible, businesses and not-for-profits will again need to demonstrate that they satisfy the actual GST Turnover Test in each of the

June, September, and December 2020 quarters relative to comparable periods.

Employee eligibility will remain unchanged but the payment rate during this period will depend on hours the same as above and will be

updated to:

- $1,000 per fortnight, reduced from $1,200.

- $650 per fortnight, reduced from $750.

Actual GST Turnover Test

To be eligible for JobKeeper Payments under the above extensions, businesses and not-for-profits will need to demonstrate that they have

experienced the following decline in turnover:

- 50 per cent for those with an aggregated turnover of more than $1 billion.

- 30 per cent for those with an aggregated turnover of $1 billion or less; or

- 15 per cent for Australian Charities and Not-for-profits Commission-registered charities (excluding schools and universities).

If a business or not-for-profit does not meet the additional turnover tests for the extension periods, this does not affect their

eligibility prior to 28 September 2020.

The Commissioner of Taxation will have discretion to set out alternative tests that would establish eligibility in specific circumstances

where it is not appropriate to compare actual turnover in a quarter in 2020 with actual turnover in a quarter in 2019, in line with the

Commissioner’s existing discretion. Information about the existing discretion can be found here.

Learn more from

Treasury on

how this will impact you or your business. Alternatively, please do not hesitate to contact our office on 02 6921 5444.